Wealth Management — “Supervised Wealth Planner Copilot”

Positioning: planning + scenario analysis + execution assistance, not “autonomous trading.”

1) Executive snapshot

ICP: independent wealth planners, RIAs, family offices, HNW individuals (with advisor oversight)

Wedge workflow: “Monthly review pack + rebalancing proposal + documentation.”

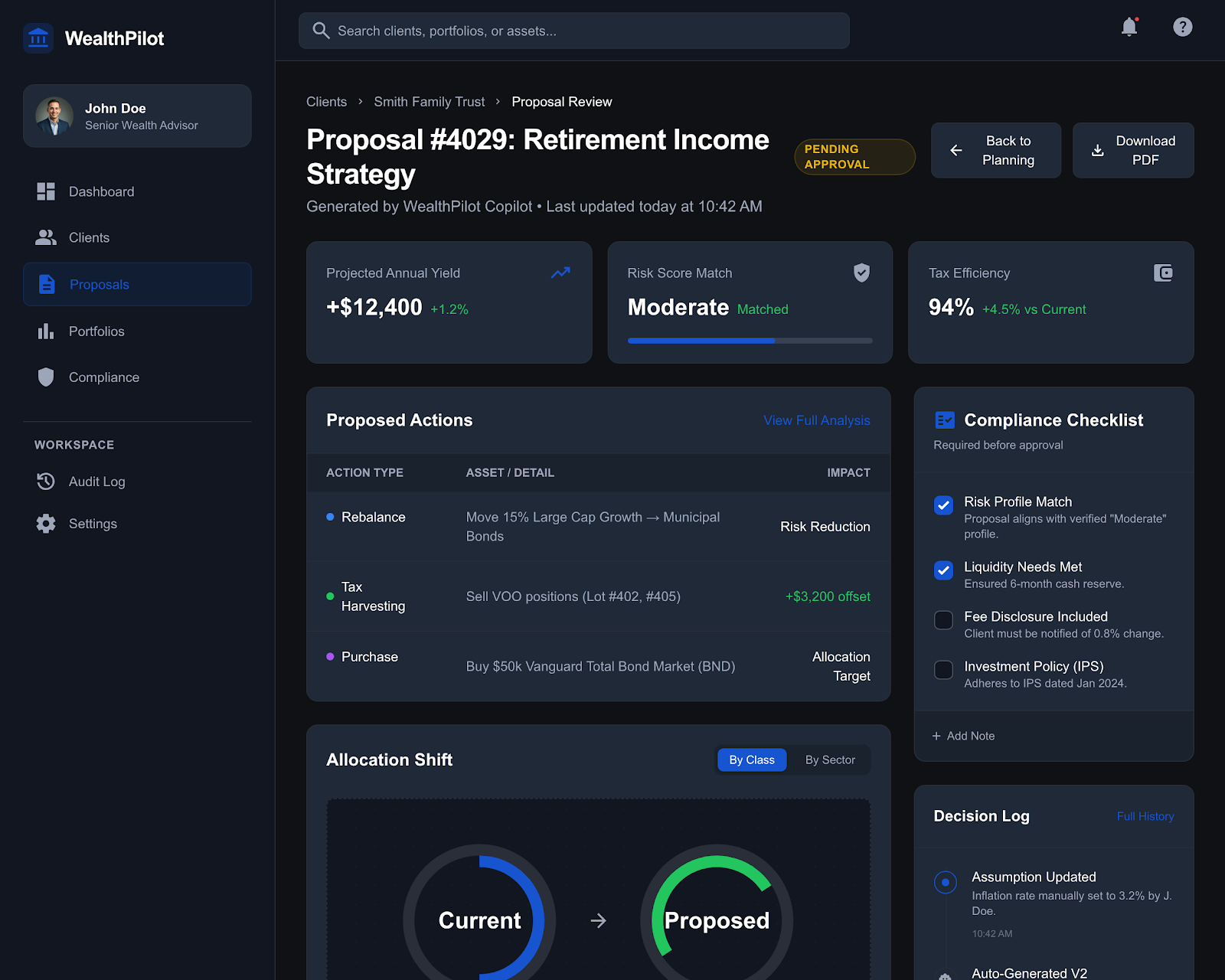

Autonomy: Supervised autopilot (agent drafts proposals; explicit approval for execution and client-facing outputs).

KPIs

- time-to-review pack

- compliance completeness

- error rate in calculations / allocations

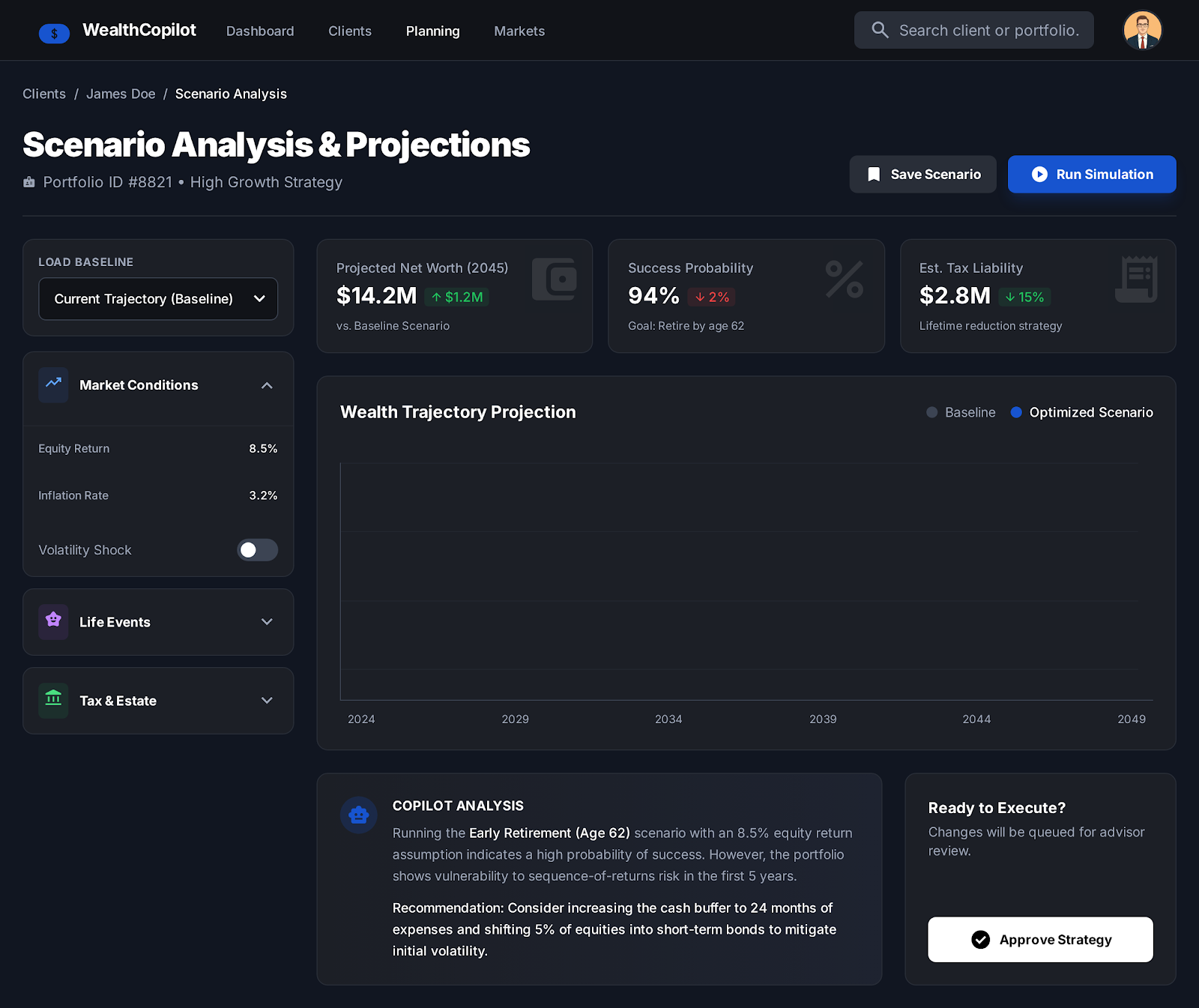

2) Product experience & UX

Advisor cockpit: intake → scenarios → proposal → approval → publish.

Trust UI: assumptions panel + citations + compliance checklist.

3) Agent design map

Skills: planner, risk manager, tax-aware reviewer (non-tax advice), compliance reviewer

Subagents: market data retriever, scenario engine, report generator, drift detector

4) Tool & data plane (MCP-centric)

Market data, holdings (read-only), CRM notes/KYC, disclosures/policies repo.

5) Context engineering plan

Pinned: IPS/risk constraints/prohibited assets/disclosures

JIT: latest holdings + market indicators

Immutable decision log: inputs + assumptions + versions per recommendation

6) Evals & observability

Offline: math correctness + constraint adherence + policy tests

Online: advisor edit distance, blocked approvals, p95 cost/pack, safety flags

7) Failure modes & mitigations

| What breaks | Detect | Constrain | Prevent regression |

|---|---|---|---|

| Ungrounded recommendations | citation/assumption checks | proposal-only mode until approval | golden set + stress scenarios |

| Unauthorized execution | tool audits | execution tools off by default; approvals | CI policy tests |

| Prompt injection via docs | OWASP detectors | sanitize + isolate; least privilege | adversarial injection eval pack |

| Compliance gaps | checklist validator | block publish unless complete | compliance regression tests |

8) Governance posture & rollout

High-risk posture: strong HITL, logging, and oversight by design.

Rollout: shadow mode → advisor-only beta → limited client publish → broader rollout.

Kill switch per capability (execute trades, send client email).

9) Business case + distribution loops

ROI: advisor hours saved + reduced errors + faster turnaround

Pricing: per advisor seat + per client case

Loops: client invites, review-pack templates, CRM embedded loop

10) Where RFT helps

- Rule-following under complex constraints (tax, risk tolerance, liquidity, drawdown limits).

- Decision discipline: consistent behavior under volatility, fewer inconsistent recommendations across turns.

- Verification-first behavior: prefer “check + cite + simulate” over guessing.

What you train on (signals):

-

Trajectories: goals → profile → constraints → portfolio proposal → scenario checks → rebalance plan.

-

Graders:

- Constraint satisfaction (hard checks)

- Policy compliance (no forbidden advice flows, proper disclaimers)

- Portfolio sanity checks (risk/return proxies, diversification heuristics)

- Cost/latency penalties for over-tooling

Business metrics it can lift:

- Higher plan completion rate (users reaching an actionable plan)

- Lower support escalations / compliance incidents

- Improved conversion to premium planning / advisory workflows (trust + reliability)